Ytd gross pay calculator

Sage earned 3500 per pay period in gross wages and Sebastienne earned 1500 per pay period. Premium paid is limited to ten percent 10 of Gross Salary.

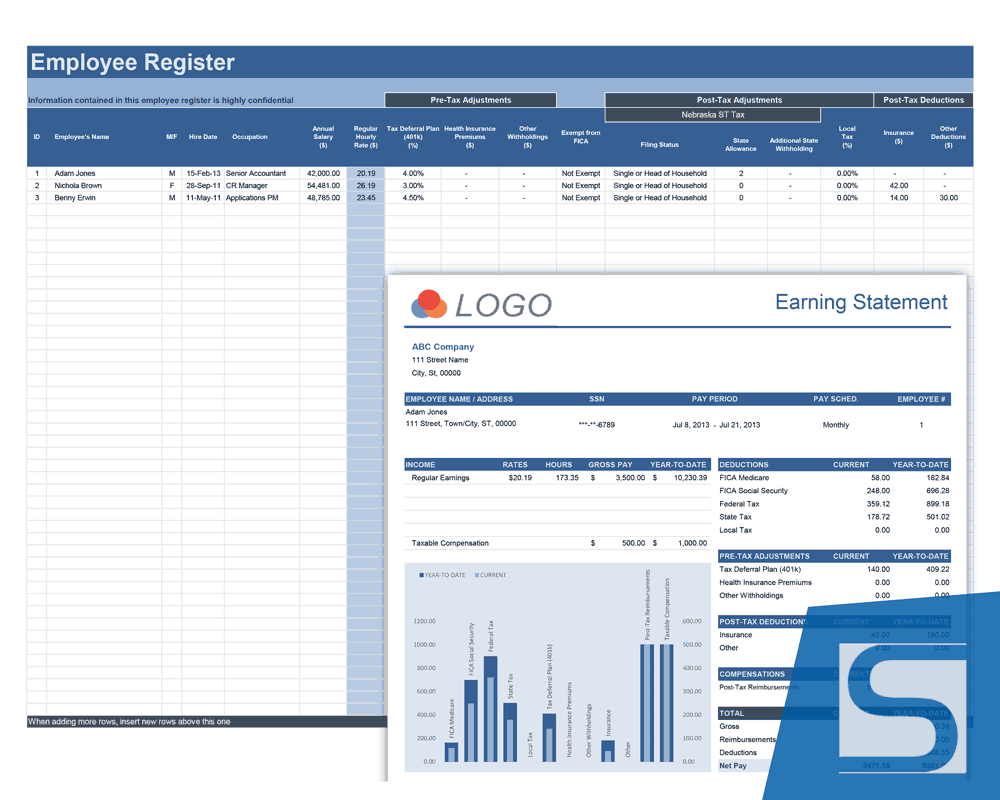

Paystub Generator With Year To Date Ytd Real Check Stubs

Switch to South Carolina hourly calculator.

. This online calculator is excellent for pre-qualifying for a mortgage. Get 247 customer support help when you place a homework help service order with us. FREE EDITABLE PAY STUB TEMPLATES IN PDF WITH CALCULATOR.

These are pretty self-explanatory. Before the deductions are made. The annual taxable income factor A is based on a yeartodate concept plus the estimated income for the rest of the pay periods in the year.

Medical and Life Insurance Premium Deduction. Oregon residents pay personal income tax. Estimate Taxes on Paycheck from Pay Stub.

Total Non-Tax Deductions. If you have only just started your job this financial year or dont want to work out your income from your group certificate then just enter 0 as the gross income shown on your. Pay Type Hours Prior YTD CP.

Use this federal gross pay calculator to gross up wages based on net pay. With Online Pay Stubs you can instantly Create pay stub for free within minutes. The pay period section should list the beginning date aka.

Federal Filing Status of Federal Allowances. Our free check stub maker with calculator will make an earnings statement with tax returns and figures out what you will owe each pay period to the state and local government. Plus if your gross wages are the.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Federal Filing Status of Federal. Weekly or bi-weekly pay date calendar with YTD or remaining gross income.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Generally this is a few days after the end date of the pay period. This paycheck stub is print-ready.

Enter the YTD gross income from your most recent payslip. Once you have calculated that add the two YTD amounts together. Enter the year-to-date income in the YTD box then choose the start and finish dates and click outside the box or the calculate button.

Federal Filing Status of Federal Allowances. Federal Filing Status of Federal Allowances. Use the Oregon hourly paycheck calculator to see your net pay after taxes.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Pay Period and Pay Date. Federal Filing Status of Federal Allowances.

We will then calculate the gross pay amount required to achieve your net paycheck. For example if the pay period was 01032019 to 31032019 then you enter 31032019 into the calculator. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Use PaycheckCitys bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The following check stub calculator will calculate the percentage of taxes withheld from your paycheck and then use those percentages to estimate your after-tax pay on a different gross wage amount.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Your businesss total YTD in payroll is 65000. These paycheck stubs can be used by employees as proof of their earnings employers can keep it for their records.

It will take you from Gross Pay to Net pay and all in between calculations as well. Take those numbers and multiply them by the number of pay periods. Determine the annual tax T1 T2 based on the annual taxable income factor A with the non-periodic payment payable now.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Then calculate the YTD year to date for the duration of the time you were. YTD means yeartodate before this pay period.

Or 360000 whichever is less. Creating free paystub using Online Paystub Generator can be used as a paystub calculator and paycheck calculator. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Health Insurance POP etc SalariedAmount. The YTD worksheet records a summary of payrolls dispersed to each employee from the beginning of the year till date. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Since weekly and biweekly payroll periods result in some months having an odd number of paydays I have included a pay date calculator to show which months have 3 biweekly pay periods or 5 weekly pay periods. Press calculate on the calculator to calculate your yearly gross income. The procedure is straightforward.

The sheet also provides a graphical view of the data that helps in understanding the payroll easily. You can either enter the year-to-date YTD figures from your payslip or for a single pay period. Pay Date Calendar Calculator.

Use this calculator to calculate your monthly and yearly income for the current year. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. The PaycheckCity salary calculator will do the calculating for you.

Pay Stub Direct has both options so you dont have to choose. This number is the gross pay per pay period. Pay stub templates must have the basic qualities of any good document ex.

For example if the pay period was 06062010 to 12012017 and the pay date was 15012017 you would enter 12012017 in the calculator. The year-to-date for Sage is 45500 and Sebastienne is 19500. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Dont want to calculate this by hand. Switch to Texas hourly calculator. The pay date section should provide the date on which the check is issued.

It also shows the Gross pay and the YTD pay. 11121 and end date aka. The Pay stub shows the detailed YTD regular hours sick hours etc.

12521 of the pay period in question. Switch to North Carolina hourly calculator. 13 of the gross amount needs to be calculated as your Non-Taxable Income then the following deductions are made.

Federal Filing Status of Federal Allowances. All calculations are completed such as net pay YTD taxes gross income and more for proper and accurate tax filing on your pay stub document.

Dave Ramsey S Baby Step Four Invest 15 Of Your Income For Retirement Investing Emergency Fund Total Money Makeover

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Income From Paystubs Hourly Weekly Session 16 Youtube

Hrpaych Yeartodate Payroll Services Washington State University

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Average Price Up 4 8 And Volume Down 7 1 Year To Date Greater Louisville Association Of Realtors Year Of Dates Academy Gurgaon

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Property Rental Income

Paystub Generator With Year To Date Ytd Real Check Stubs

Online Check Stub Calculator With Year To Date Information Stub Creator

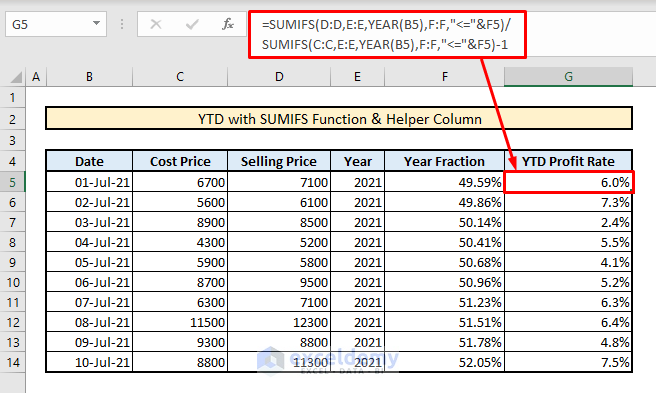

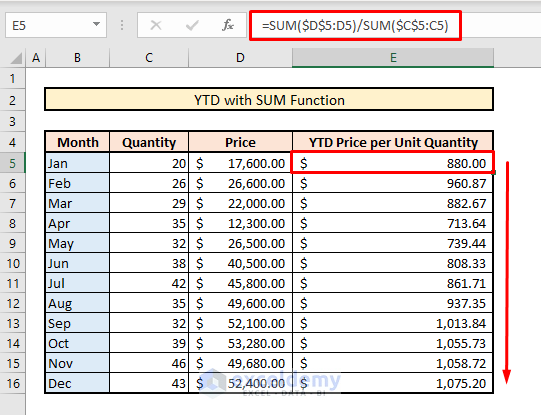

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

What Is The Ytd Amount On A Pay Stub Quora

Ytd Calculator And What Is Year To Date Income Calculator

Ytd Calculator And What Is Year To Date Income Calculator

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

Pay Stub Maker Create A Paycheck Paycheck Stubs Stub Samples Words To Describe Year Of Dates Paycheck

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube